Trump Crypto Portfolio Rebalancing Continues: What Does He See That Traders Don’t?

Key Insights:

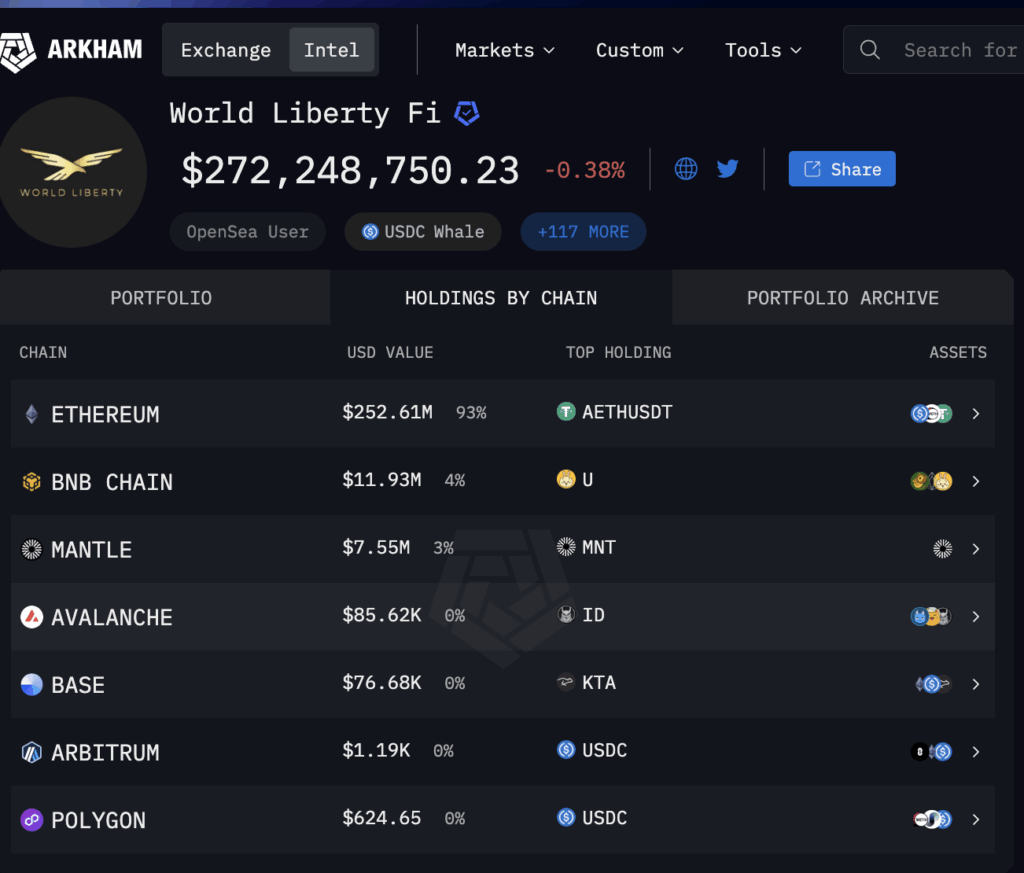

- Ethereum dominates 92% of the Trump crypto portfolio, spanning restaked, native, and L2 ETH, signaling strong conviction.

- RWA tokens on BASE and governance tokens on Avalanche, Mantle, and BNB form the remaining bets; no meme coins or noise.

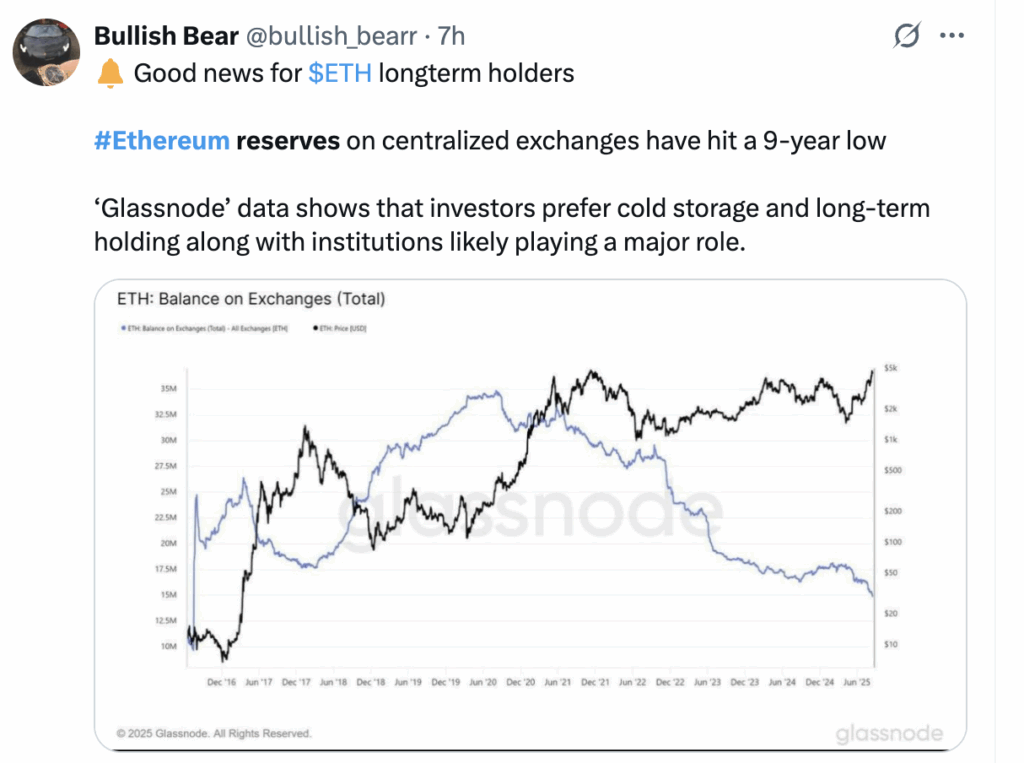

- ETH exchange reserves are at multi-month lows, aligning with Trump’s positioning and hinting at a long-term bullish setup.

Trump’s crypto portfolio shows a very clear pattern: Ethereum now accounts for over 92% of his total crypto holdings via the World Liberty Finance wallet. And that’s not all.

The holdings span multiple versions of ETH, including native Ethereum, restaked assets, and bridged ETH on Layer 2s. This concentration, paired with dwindling ETH exchange reserves, indicates a long-term conviction bet.

Trump’s allocations make up the rest, with altcoins and speculative bets comprising the remainder, and are spread strategically across chains. From RWA tokens on BASE to governance coins on BNB and Avalanche, the entire setup looks more intentional than reactionary.

So what is Trump seeing that most traders are missing?

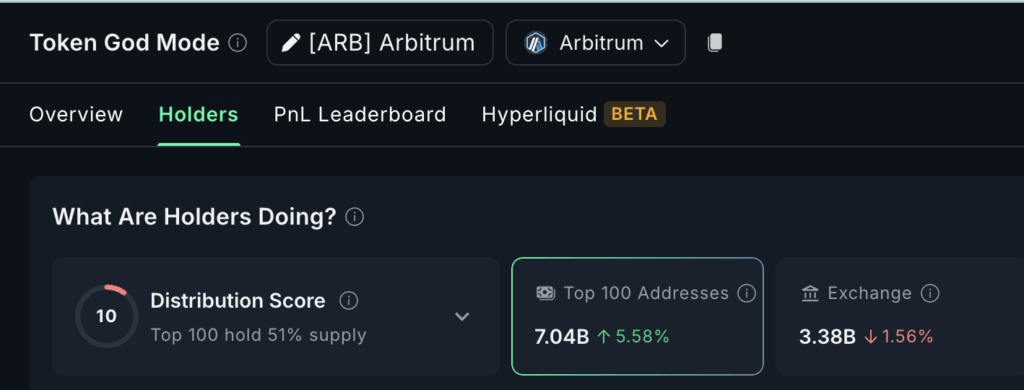

Ethereum Dominance Hits 92% in Trump Crypto Portfolio

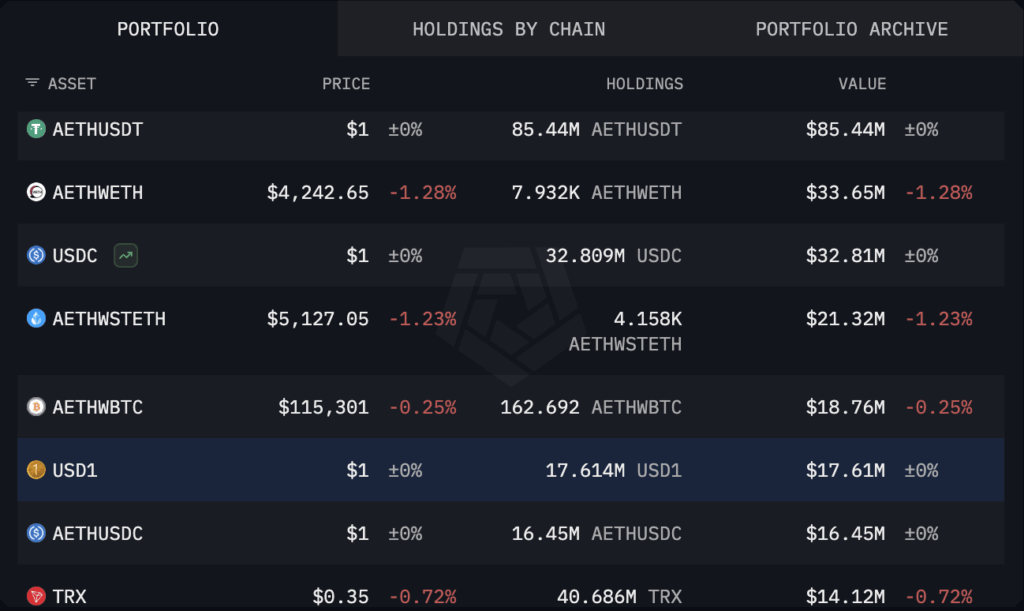

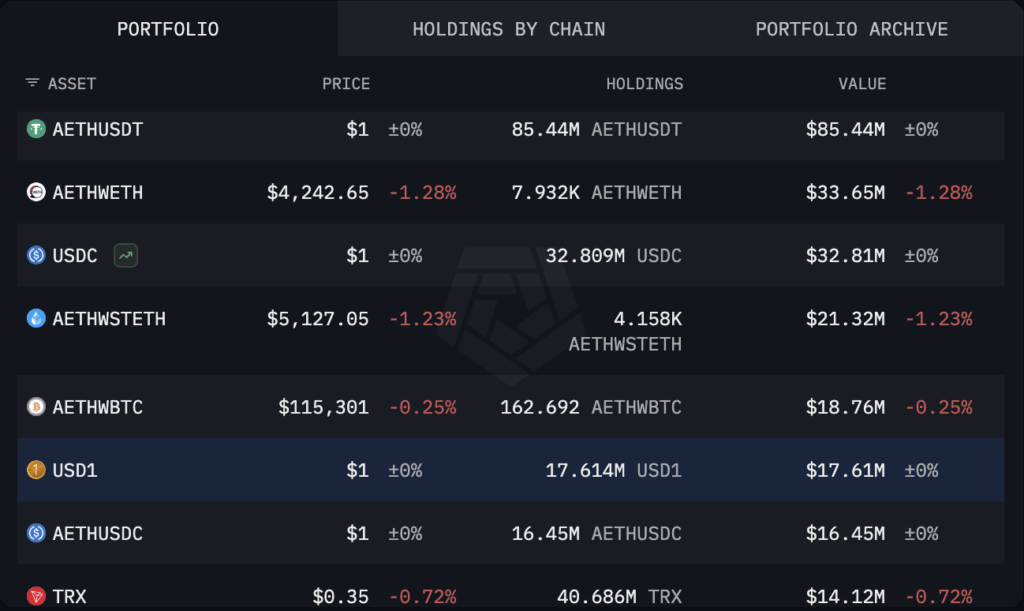

Trump’s crypto portfolio isn’t holding just one type of ETH. He has a massive $33.6 million exposure to AETHWETH (Aave Ethereum Wrapped Ether), which is the wrapped and restaked version of Ethereum.

Alongside that, there’s native ETH, ETH bridged to Optimism, and ETH positions on Arbitrum. This isn’t just passive exposure; it reflects a strategy focused on long-term ETH network strength across layers.

On-chain data shows ETH exchange reserves are at multi-month lows. This includes ETH on Binance and Coinbase. These moves suggest whales are removing ETH from centralized platforms despite retail continuing with the selling.

Ethereum price action hasn’t caught up yet. Yet these wallet trends, including the WLFI one, signal preparation for something bigger. Trump’s early rebalancing may be a frontrunning signal for the ETH price move.

BASE and Avalanche Bags Signal a Tilt to Real-World Assets

Outside of ETH, Trump’s crypto portfolio stretches across BASE, Optimism, Mantle, and Avalanche, Arkham Intelligence data showed. On BASE, the top holding is KTA, a token tied to real-world asset (RWA) tokenization. That’s a clear nod toward the RWA narrative gaining ground.

On Optimism, he holds ETH itself, reinforcing a preference for layer-2 ecosystems. He’s not just chasing airdrops; he’s sitting on base-layer assets.

Meanwhile, Avalanche holds its position in ID, the governance token of SPACE ID, a multichain naming service. The tokens held on each chain are tied to core functions, not meme coins or flyers.

Mantle and Linear Show Mid-Cap Focus of the Trump Crypto Portfolio

Trump crypto holdings also added MNT on Mantle, which recently crossed the $1 mark, right after whale wallets picked up more.

Although these aren’t huge allocations, they show he’s diversifying into second-tier protocols with real user metrics.

Notably, even TRX and EOS make appearances in the portfolio.

What Does Trump’s Crypto See?

While retail eyes airdrop speculation, Trump crypto portfolio stays focused on base layers, governance ecosystems, and RWA enablers. The presence of USDT and stablecoin-heavy positions shows capital is being parked rather than aggressively rotated. It’s a “wait and watch” mode, but one already anchored in long-term chains.

The World Liberty Finance wallet is publicly linked to Trump’s broader blockchain play. That makes this portfolio more than a cold wallet. You can consider this a signal of positioning from one of the highest-profile crypto adopters this cycle. Whales seem to be following suit.

Meanwhile, with over 92% of holdings in Ethereum-based assets, this is a bet on infrastructure. The presence of chain-native governance tokens across Mantle, BASE, Avalanche, and BNB shows an awareness of evolving ecosystems.

From real-world asset exposure to clean Layer 2 bets, this Trump portfolio might not scream “bull market frenzy,” but it whispers something else: readiness.

The post Trump Crypto Portfolio Rebalancing Continues: What Does He See That Traders Don’t? appeared first on The Coin Republic.