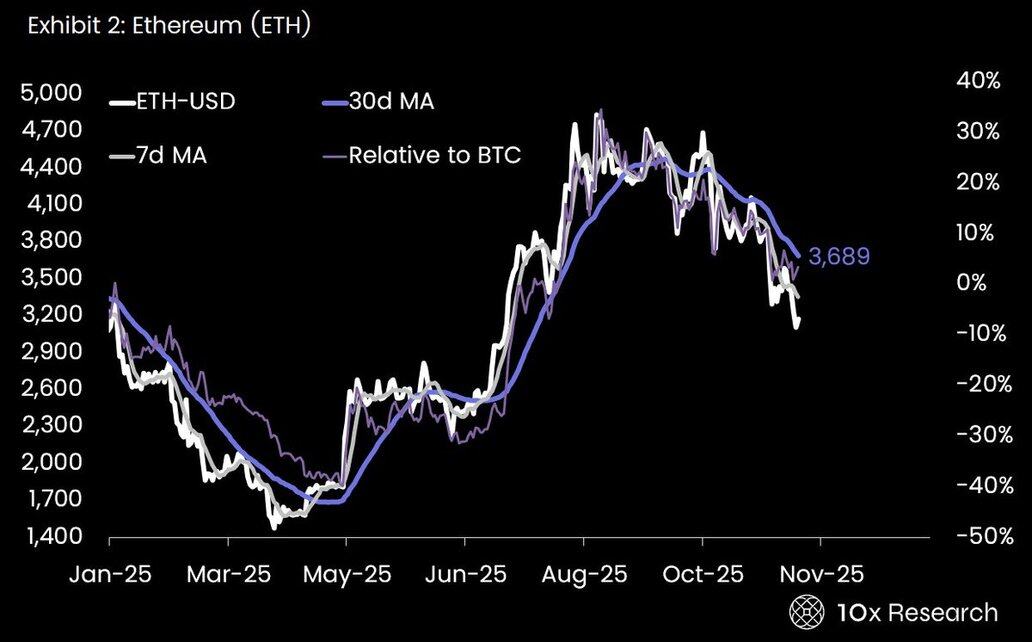

Ethereum (ETH-USDT is below the 7-day moving average -> bearish, and is below the 30-day moving average -> bearish, with 1 week change of -6.6%) ETH ETFs saw over $1.4 billion in net outflows and long-term holders accelerated selling.

Large “whale” addresses accumulated hundreds of thousands of ETH (worth over $1 billion) during the dip.

On-chain data shows long-term ETH holders (3-10 + years) are selling at the fastest pace since 2021, creating supply pressure.

Read our weekly "Crypto Trends Chart Book: Understand What is Moving in the Market and Why" with analysis for 50+ coins:

1.41萬

3

本頁面內容由第三方提供。除非另有說明,OKX 不是所引用文章的作者,也不對此類材料主張任何版權。該內容僅供參考,並不代表 OKX 觀點,不作為任何形式的認可,也不應被視為投資建議或購買或出售數字資產的招攬。在使用生成式人工智能提供摘要或其他信息的情況下,此類人工智能生成的內容可能不準確或不一致。請閱讀鏈接文章,瞭解更多詳情和信息。OKX 不對第三方網站上的內容負責。包含穩定幣、NFTs 等在內的數字資產涉及較高程度的風險,其價值可能會產生較大波動。請根據自身財務狀況,仔細考慮交易或持有數字資產是否適合您。